Shanghai Industry Talk-Fests Offer Much Food For Thought

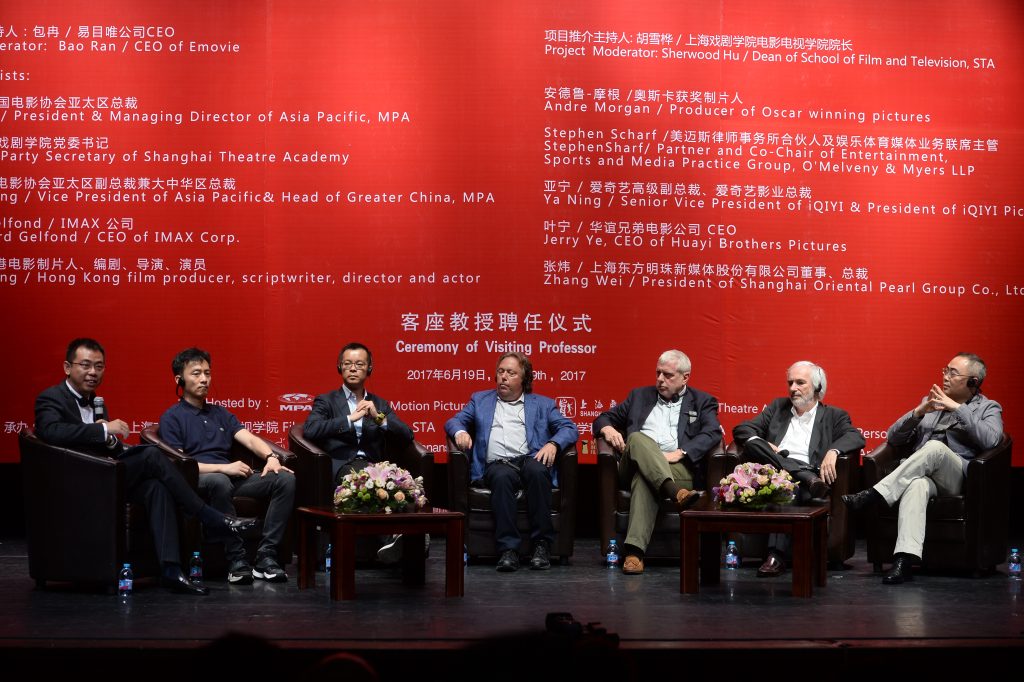

4th Global Film Industry Value Chain Development Forum:

Investing in the film industry is a high risk business, and doubly so if you’re operating in an unfamiliar market like China where the laws, customs and business etiquette can seem difficult to fully comprehend. Fortunately for those attending the 4th Global Film Industry Value Chain Development Forum on June 19, hosted by the MPA and Shanghai Theatre Academy, gaining clarity on these issues was the order of the day.

Panelists:

- Bao Ran, CEO of eMovie

- Richard Gelfond, CEO of Imax Corp.

- Sammo Hung, Hong Kong Film Producer, Scripwriter, Director and Actor

- Andre Moragan, Oscar-Winning Producer

- Stephen Scharf, Partner and Co-Chair of Entertainment Sports and Media Practice Group, O’Melveney & Myers LLP

- Ya Ning, Senior Vice President of iQiYi & President of iQiYi Pictures

- Jerry Ye, CEO of HuaYi Brothers

- Zhang Wei, President of Shanghai Oriental Pearl (Group) Co.

So – completion bonds: Are they needed in China or not? Listening to Jerry Ye, the answer is an unambiguous Yes. China would do well to adopt a film guarantee mechanism, such as a completion bond, to help facilitate good production, argues Ye. Oh contraire, countered Andre Morgan – Implementing such a policy flush with completion bonds would only slow down the industry. China’s film industry growth, said Morgan, was organic and should be left to evolve naturally in the future. Zhang Wei argued that financing in China is still in its preliminary stages, and the country’s economic structure was not yet equipped for such sophistication.

Legal hats were donned for the second panel. Stephen Scharf reflected that the role of a lawyer in the U.S. differs widely from the role of a lawyer in China. In the U.S., a lawyer is present from the very beginning to structure the deal and guarantee that it accomplishes its goals. They have neither a creative role, nor a say in whether or not a movie gets made. In China, it’s the business people that drive the deal, and the lawyers appear later in the game. Scharf suggested that China adopt a more western model to help ensure the whole project runs smoothly from start to finish.

With all the advancements in technology, there has been a major disruption to traditional film distribution. It has become easy to stream a movie at the click of a button, but does this mean movie theaters are dead? In terms of whether to invest in traditional or non-traditional distribution models, Ya Ning and Rich Gelfond agreed that both models are equally important for different reasons: Movies with intense special effects often attract movie-goers to the theater, while a movie with minimal special effects is more likely to be streamed. It’s worth investing in both.

The question was asked: Why are Chinese banks not investing in the country’s film industry? Is this a red flag? Scharf suggested that banks should take on one of the numerous advanced models of risk mitigation, such as investing a portfolio of films. In this way, rather than financing just one film and “putting your eggs in one basket”, the banks can best mitigate risk.

Our experts agreed on three takeaways from the discussion:

1. Understand the market and infrastructure before you invest;

2. Invest in a solid company with good management and a sound financial plan; and

3. Be fully aware of your risk and who you’re investing in.

Winston Baker Keynote Conversations:

On Tuesday, the who’s who of the film industry gathered to discuss the future of China and Hollywood at Winston Baker’s Keynote Conversations at the Shanghai Exhibition Center. During the event, game changers and dealmakers in the entertainment industry addressed the shifting paradigm that has disrupted the entertainment sector within China, the US and impacted on the international marketplace.

MPA’s Mike Ellis opened the event by providing insights into China’s booming market. Over the past years, annual ticket sales in China have skyrocketed from 6 billion in 2009 to 45.7 billion RMB in 2016, despite the relatively slow year on year growth of 3.7% in 2016. Ellis noted that the cooperation between the Chinese and U.S. industries is currently at an all-time high, not only on the level of commercial engagement, but across all aspects of film industry engagement and knowledge sharing.

During the first panel conversation, “The Next Chapter for the China-US Motion Picture Industry”, moderator P. John Burke of Akin Gump questioned panelists about the restrictions on overseas media and entertainment transactions. Panelists agreed that while we may not be seeing a great deal of increased domestic spending in the film market, there has been an increased focus on the quality of content and production in the industry. China has also made great leaps in terms of its technology and digital marketing strategies. Joe Austin, of WME IMG China, contemplated the fact that China has advanced quickly with the introduction of new digital strategies like WeChat and easy online payment systems, while the U.S. continues to employ rudimentary tactics like billboards and TV ads to market films. China and the U.S. can continue to learn from each other as both markets evolve.

“The Role of Internet Companies in Revolutionizing Content Creation and Distribution” with Jason Goldberg of Covington and iQiYi Senior Vice President Yang Xianghua, cut straight to the hot topic of the deal between iQiYi and Netflix. While iQiYi is open to adding a variety of Netflix programs to their library, one of the key problems is the taste of Chinese audiences. In America, audiences prefer to watch a movie or television show based on the content and quality of the program, while in China, audiences are focused on the looks of the actors, rather than their talent. To deal with this issue, iQiYi has launched various initiatives that focus on developing the talent of Chinese creatives. Last year, the company went so far as to launch a show not involving Chinese celebrities, and by year’s end, they had a hit.

Roy Salter opened our eyes to “The Future of Television and Feature Programming in the Shifting Global Landscape” in an engaging keynote address. He argued that success is best achieved through the ability to: identify commercial and creative potential of raw IP, commercially secure it; develop it into commercially effective business models; assess its commercial potential before expending sizeable resources; design risk mitigating financing options; formulate integrated production, marketing and distribution – up front; manage production within budgets; design program and brand marketing; effectively administrate each effort; and create a positive working ‘culture’. Quite some “to do” list! With careful planning and determination, great ideas have never been more likely to translate into great outcomes.

Armanino’s Mark Hutchison and Leeding Media CEO David U. Lee broke down “The Top 10 Things You Need to Know When Making a Movie with Foreign Partners”. Here are the standouts for me:

1. Creative Process: Movies with a compelling story and characters you care about are more likely to succeed both domestically and internationally;

2. Free Money: Film incentives and other forms of “free money” are integral to making a film, but there is often a cost to borrowing money, so take care;

3. Legal Advice: Everything you touch is a contract, so attorneys are extremely important. Make sure you have a good attorney!;

4. Relationships: These are key, especially when conducting international business. Relationships can take years to develop and understanding cultural differences is significant in this business;

5. Fundraising: Just remember BATW: Baidu, Alibaba, Tencent, Wanda.

Steve Xiang, CEO of Huanxi Media Group and O’Melveny and Myers’ Matthew Erramouspe took us through “Evolving the Industry: New Model for Quality Content, Creativity, and Growth”. It has become extremely expensive to enter into a commercial relationship with top tier Chinese directors. Huanxi discovered a way to help fix this problem – by aligning interests with the directors and giving them a stake in the company. In exchange for equity in the company, directors are able to work more efficiently. How does Huanxi survive alongside the country’s industry giants such as Alibaba and others? Huanxi separates itself from the other companies because it focuses on the beginning and end of the supply chain: They are able to lock in important resources such as content creation and at the other end they are able to focus on the audience through their online movie app platform. Huanxi leaves the middle of the supply chain for those industry giants who have more resources and greater expertise.

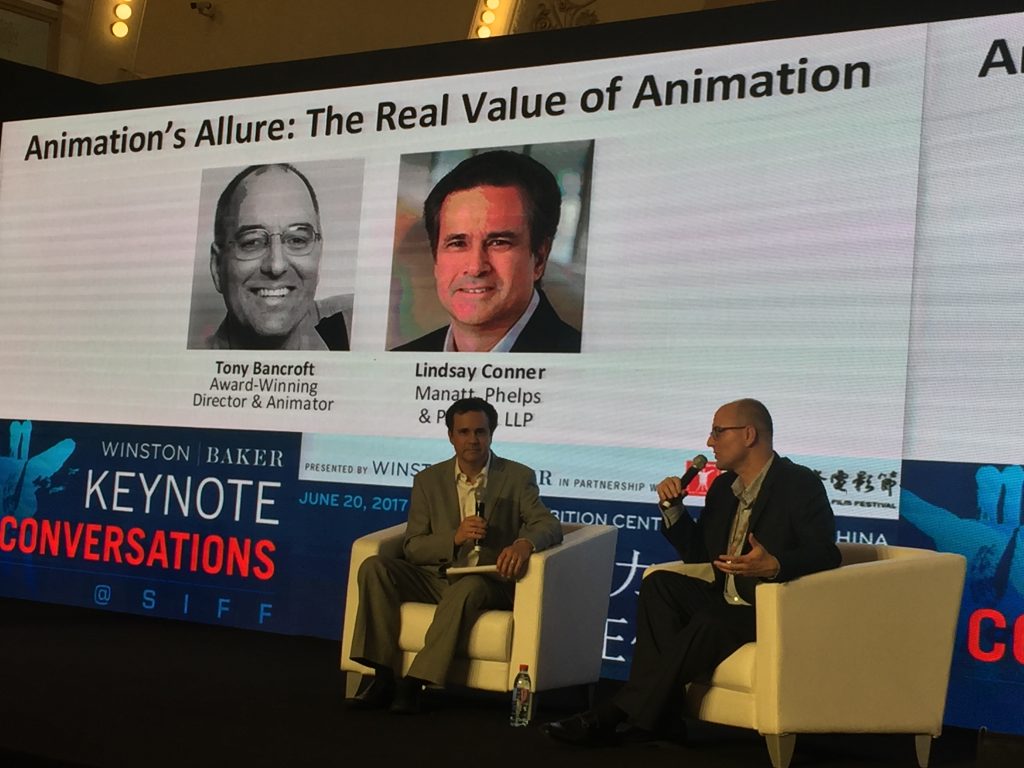

Mulan director Tony Bancroft and industry veteran Lindsay Conner of Manatt, Phelps & Phillips went to town with “Animation’s Allure: The Real Value of Animation”. In terms of co-production, Bancroft pointed out that animation often travels better than live-action film. Humanizing animals travels well, because the audience is able to connect emotionally with the characters, but each culture maps their own identity onto the characters. In the future, Bancroft believes that new platforms will continue to open up new resources for animation. Animation is iconic.

Winston Baker’s Keynote Conversations in Shanghai took on a big subject, and brought expert insights to the fundamentals of business between the two giants of the global film industry.

Emily Vogel is an Event Producer at Winston Baker, which organizes conferences globally for the entertainment industry addressing strategies for innovation, finance and growth. Vogel is a graduate of the University of Southern California.